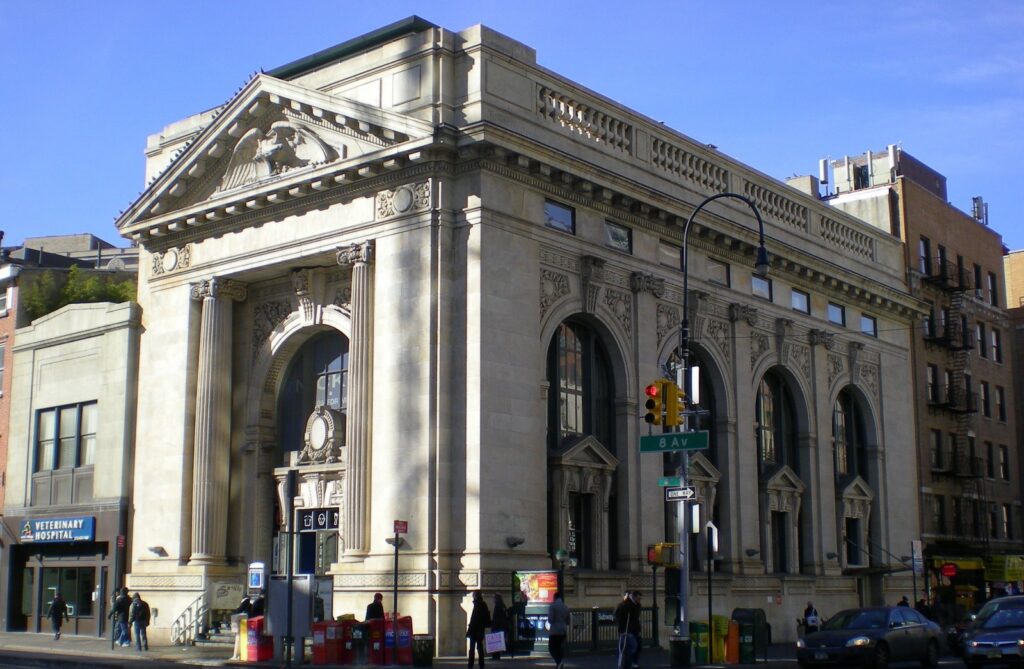

Daily Banking

Today’s challenges in retail banking are numerous: regulatory changes, rising customer expectations, new competition, and open banking are weighing in on profitability. We help to enhance your daily banking by adding new features, improving customer experience and loyalty, and the introduction of robotics automation. Supply of data that can serve as a source for value creation and as such we rely on insights mined from transaction histories and consumer research in order to understand customers better, predict behaviors, and make a bank’s offerings more intuitive leading to greater customer satisfaction.

Savings and Loans

Data mining and lean end-to-end processes play an important role in providing an exceptional service to your customers. Employing new capabilities of cloud services, data, automation, and analytics, are helping banks make a crucial step forward. Lending process improvements such as reducing and replacing paper, further automation of the loan decision process and performance analysis are activities we can assist you in so to increase your lending portfolio profitability.

AML detection, investigation and reporting

We assist in the redesign and optimisation of internal processes as to meet supervisory regulations, including the generation of reports to the authorities.

Analysing the onboarding process and alerts by AML control teams, enables compliance to regulation for financial behavior potentially linked to money laundering or terrorism financing such as the management of multiple whitelists and blacklists.

Risk and Compliance

Regulatory compliance and financial risk are ever-present and ever-changing threats within banking and finance. Compliance functions are a key component of banks’ second line defence for managing risks and operate with integrity and adhere to applicable laws, regulations and internal policies. We assist in your plans to scale up the means to implement compliance-related policies and processes, and establish risk management controls throughout the entire process.

Payments, Clearing & Settlement

Financial markets and banks facilitate a wide range of high-value transfers e.g. money transfers and foreign exchange settlement. Our best practices address the complexity of the interconnections between banks in the payments, clearing and settlement environment. They seek to affirm sound existing practices and suggest enhancements to generally practiced behavior. Our best practices will be shared, new practices added and existing practices modified to better address your challenges.

Online Banking

Online banking refers to the overall experience of banking through digital channels, including mobile apps, desktop, live chatbots, and more. Mobile banking has become the go-to method and a key differentiator for banks and financial institutions. We understand how leading banks and digital-only banks are raising the bar for customer expectations and follow-up closely on new technologies such as blockchain, artificial intelligence, chatbots, and the Internet of Things, that will impact banking by streamlining processes and cutting costs.

Solution Integration

The importance of security and shifts in technology, require the optimisation and streamlining of end-to-end processes and systems. As organisations adopt cloud services to connect to customers, partners and employees, the integration of solutions which connect on-premises with cloud services, has become inevitable. For an organisation to fully exploit its data, a new approach to integration is required, one that delivers true enterprise level results and a highly scalable platform to integrate applications, data and processes. Banks can benefit from the integration expertise our qualified consultants have developed in integrating banking and financial solutions.